An International Driving Permit (IDP) issued in any country other than South Africa (RSA), is valid to drive with in the RSA if:

- The IDP was issued on a date on which the holder thereof has not been permanently or ordinarily resident in the RSA. A person is permanently resident in the RSA if he/she is a RSA citizen, or disposes over an official document issued by the Department of Home affairs that grants the right to permanently reside in the RSA, and he/she resides in the RSA. Contract workers and visitors are not permanently resident in the RSA if they do not comply with the aforementioned conditions, regardless of the length of their stay in the RSA and therefore the IDP will be valid until expiry. A person is ordinarily resident in the RSA if he/she is in the RSA on an extended visit of more than three months on a contract of employment (not just visiting); and

- The IDP is accompanied by the driving licence on the authority of which such permit was issued. The driving licence may have been issued at any time even if the person resided permanently in the RSA at the time the licence was issued and may be in any foreign language and without a photograph and signature; and

- The IDP is valid (i.e. it has not expired yet).

An IDP remains valid until the expiry date of the IDP OR until the driving licence on the authority of which such permit was issued is no longer valid OR until the holder thereof has been permanently resident for a continuous period of 1 year in the RSA, whichever is earlier.

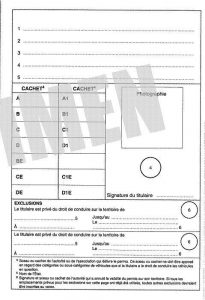

The holder of an IDP may drive a motor vehicle of the appropriate class for own use. The person concerned may not drive a motor vehicle for which a professional driving permit is required.

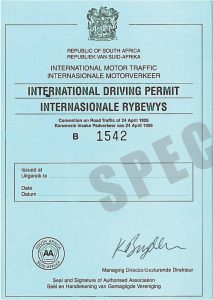

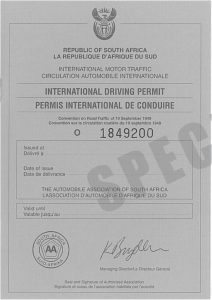

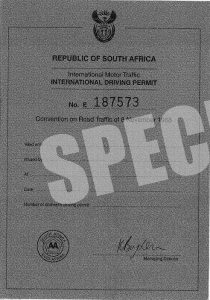

How to Get an International Driving Permit in South Africa?

An International Driving Permit is a translation of your national driving license. The IDP allows motorists to drive vehicles in foreign countries. You must always have your IDP along with your national license at all times. To get an International Driving Permit in South Africa, visit AA South Africa.

Contact:

For more information, contact our Travel Office Directly on:

Call 0861 000 234 (select option 5, then option 1).

Available Monday to Friday, from 08h00 – 17h00.

A complete list of National Sales agents is available on the AA South Africa Website

More Information:

An International Driving Permit (IDP) is a legal document, valid for 1 year or until the expiry of your driver’s licence, whichever comes first.

In many countries English is not an official language, so your IDP will provide a translation of your South African driver’s licence into several languages as well as the five official UN languages. This allows your licence to be read and understood in many countries. It also provides validation of your South African driver’s licence, and an alternative proof of identification when you travel in foreign countries and need to rent a car or obtain insurance.

An International Drivers Permit must be applied for in the country in which you obtained your driver’s licence before you travel. South African residents can apply online through the South African Automobile Association. Please note that The AA cannot issue an IDP to citizens of Botswana, Lesotho and Swaziland who are in the possession of a valid driver’s licence issued in that country but The AA can issue an IDP to citizens of Namibia who are in the possession of a valid Namibian driver’s licence.

Requirements:

All you need to do is fill out an application form, submit a photo and copies of the following valid documents:

• South African Identity Document

• A valid South African driver’s licence (please check expiry date before applying)

• Your postal code

• Two (2) glossy passport size photograph per International Driving Permit type.

(Photographs can be taken at selected stores. Please confirm with store before collecting your IDP)

How does the International Driving Permit application process work?

• Once you have submitted your application it will be sent to your chosen AA Accredited Sales Agent store for processing

• You will receive confirmation by email that the store has received your application. The contact details and address of the store are included in the email. Please bring this confirmation email with as proof of your order.

• Please bring all of your documents with you (as listed above) when you collect your International Driving Permit

• You will leave with your official International Driving Permit

Related Resources

Tax and Insurance in South Africa: What You Need to Know in 2025

In South Africa, understanding the relationship between tax and insurance is essential for protecting your financial future and making the most of available tax benefits. Whether you're an individual, a freelancer, or a business owner, the smart use of insurance can help you reduce your tax liability and safeguard your assets.

Why Insurance Matters for Tax in South Africa

Insurance is more than just a safety net—it can also have a direct impact on your tax situation. From medical insurance to business insurance, certain premiums and policies may qualify for deductions or influence how you declare your income and expenses to SARS (the South African Revenue Service).

- Tax Deductions: Certain insurance premiums, especially related to medical schemes and business cover, may offer tax advantages.

- Asset Protection: Insurance helps manage risk, ensuring you’re financially secure when unexpected events occur.

- Estate Planning: Life insurance can play a key role in reducing estate duty and ensuring a smooth transfer of wealth.

Types of Insurance and Their Tax Implications

1. Medical Insurance (Medical Schemes)

If you're contributing to a registered medical aid, you're entitled to a Medical Scheme Fees Tax Credit (MTC). This credit is a fixed amount per month for you and your dependents and reduces your overall tax liability.

2. Life Insurance

While life insurance pay-outs (on death) are generally not subject to income tax, they can be considered when calculating estate duty. Policies structured under a trust or with specific beneficiaries may help reduce the overall tax burden on your estate.

3. Short-Term Insurance (Vehicle, Home, Contents)

Personal short-term insurance is not tax-deductible for individuals. However, if you use part of your home or vehicle for business, the portion of insurance premiums related to business use may be claimed as a business expense.

4. Business Insurance

For companies and self-employed individuals, business insurance premiums—such as professional indemnity, commercial property cover, or key person insurance—are usually tax-deductible as operating expenses.

5. Disability and Income Protection Insurance

The tax treatment of disability insurance changed in recent years. Payouts from income protection insurance are now generally taxed as income, but premiums are not tax-deductible. Understanding this shift is important when planning your cover.

Tax Tips to Maximise Your Insurance Benefits

- Keep Detailed Records: Always keep documentation of insurance premiums, especially those linked to business or medical expenses.

- Consult a Tax Practitioner: SARS regulations around insurance and tax can be complex. A registered tax advisor can help ensure you claim all available deductions correctly.

- Review Policies Annually: Update your insurance portfolio regularly to ensure your cover aligns with your income, expenses, and current tax laws.

- Use Structuring Wisely: For high-net-worth individuals, structuring life insurance policies within a trust can reduce estate duty exposure.

Frequently Asked Questions: Tax and Insurance in South Africa

Q: Can I deduct life insurance premiums from my South African taxes?

A: No, life insurance premiums are generally not deductible. However, they may play a key role in estate planning.

Q: Are medical aid contributions tax-deductible?

A: Not exactly. Instead, you receive a Medical Tax Credit—a fixed monthly rebate that reduces your tax payable.

Q: Can I claim car insurance as a tax deduction?

A: Only if the vehicle is used for business purposes. You can claim the business-use portion of your vehicle insurance.

Q: Is business insurance tax-deductible in South Africa?

A: Yes. Business insurance premiums related to company operations are generally tax-deductible.

Final Thoughts

In South Africa, insurance isn't just about protection—it's a strategic tool for managing your tax liability, preserving wealth, and supporting long-term financial stability. Whether you’re reviewing your medical insurance, planning your estate, or choosing the right business insurance, it’s essential to understand how these choices affect your tax outcomes.

With the right advice and a well-structured insurance portfolio, you can reduce your tax bill while ensuring comprehensive protection for yourself, your family, or your business.