The Motor Vehicle Crashes section on the NaTIS website also makes it easy for people to report accidents online instead of calling the South Africa Police Services, Insurances, or Emergency Rescuers to report the incidents. Please note that you cannot apply for a drivers license in South Africa for free, and the relevant authorities at NaTIS dispose of driving permits that are not collected within 120 days.

How to check my drivers licence status online in South Africa

A vehicle owner should create a profile on the NaTIS website to get a motor vehicle renewal notice (MVL2) two months before its expiry date. This way, you can renew your drivers license on time. Here is how you check a drivers license status online:

- Visit the NaTIS website.

- Click Query Driving License Card.

Donate now and save a life! Join Briefly x Gift of the Givers blanket drive!

Source: UGC

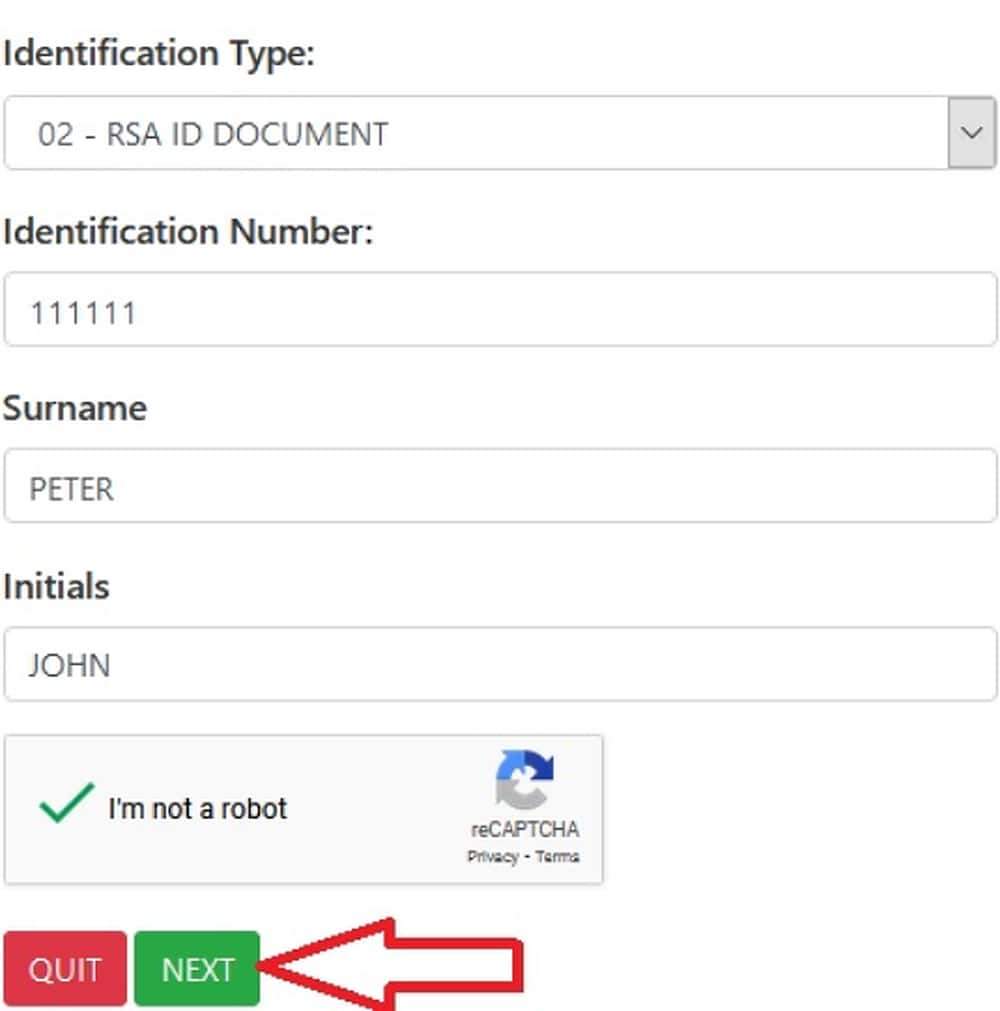

- Fill out your ID type, ID Number, Surname, and Initials.

Source: UGC

- Click Next.

- Fill out the remaining details to see your drivers license status.

How can I track my license card status via SMS?

South Africa has an SMS service for you to check your license card’s progress after applying for renewal. Here is how to check if a drivers license is ready for collection in South Africa via text:

- Text your ID number to 33214.

After a few minutes, you should receive a message indicating the license’s status. However, please be aware that this is not a government-provided programme.

Therefore, you cannot use free texts and similar packages on your phone contracts to send an SMS to this number because it will not be delivered. Instead, you need airtime to access this service.

How long is a drivers licence status check process?

It takes four to six weeks for your official drivers license card (the one that fits so neatly in your wallet) to be ready. However, checking your document’s status online or via SMS is instant.

Drivers license card collection

Collect your drivers license card from the same testing center where you applied.

Can someone else collect my drivers license in South Africa?

If you need someone to collect the drivers license on your behalf, send them to the same testing center where you applied with an affidavit and a certified copy of your ID.

The affidavit should have the name and ID number of the person you are sending and explain why you cannot collect the document. The person should also bring a certified ID copy to prove you sent them.

What is the NaTIS drivers licence collection fee?

Motorists will now have to pay R22 per application when using the NaTIS online booking applications for driving licence card renewal services and R250 for online reservations to renew the driving permits.

The affidavit should have the name and ID number of the person you are sending and explain why you cannot collect the document. The person should also bring a certified ID copy to prove you sent them.

What is the NaTIS drivers licence collection fee?

Motorists will now have to pay R22 per application when using the NaTIS online booking applications for driving licence card renewal services and R250 for online reservations to renew the driving permits.

Last year’s gazette from the government also stated that motorists would be charged R700 for online registrations of motor vehicles and R700 for online change of ownership of motor vehicles.

Since there are no pricing updates as of July 2022, you can assume that this remains unchanged. Check the NaTIS FAQS page for more information regarding driving permits.

Hope you have learned something regarding how to check if a drivers license is ready for collection in South Africa. Do not persevere unnecessarily in queues when you can “check my drivers licence status online in South Africa” online or via SMS.

Related Resources

Tax and Insurance in South Africa: What You Need to Know in 2025

In South Africa, understanding the relationship between tax and insurance is essential for protecting your financial future and making the most of available tax benefits. Whether you're an individual, a freelancer, or a business owner, the smart use of insurance can help you reduce your tax liability and safeguard your assets.

Why Insurance Matters for Tax in South Africa

Insurance is more than just a safety net—it can also have a direct impact on your tax situation. From medical insurance to business insurance, certain premiums and policies may qualify for deductions or influence how you declare your income and expenses to SARS (the South African Revenue Service).

- Tax Deductions: Certain insurance premiums, especially related to medical schemes and business cover, may offer tax advantages.

- Asset Protection: Insurance helps manage risk, ensuring you’re financially secure when unexpected events occur.

- Estate Planning: Life insurance can play a key role in reducing estate duty and ensuring a smooth transfer of wealth.

Types of Insurance and Their Tax Implications

1. Medical Insurance (Medical Schemes)

If you're contributing to a registered medical aid, you're entitled to a Medical Scheme Fees Tax Credit (MTC). This credit is a fixed amount per month for you and your dependents and reduces your overall tax liability.

2. Life Insurance

While life insurance pay-outs (on death) are generally not subject to income tax, they can be considered when calculating estate duty. Policies structured under a trust or with specific beneficiaries may help reduce the overall tax burden on your estate.

3. Short-Term Insurance (Vehicle, Home, Contents)

Personal short-term insurance is not tax-deductible for individuals. However, if you use part of your home or vehicle for business, the portion of insurance premiums related to business use may be claimed as a business expense.

4. Business Insurance

For companies and self-employed individuals, business insurance premiums—such as professional indemnity, commercial property cover, or key person insurance—are usually tax-deductible as operating expenses.

5. Disability and Income Protection Insurance

The tax treatment of disability insurance changed in recent years. Payouts from income protection insurance are now generally taxed as income, but premiums are not tax-deductible. Understanding this shift is important when planning your cover.

Tax Tips to Maximise Your Insurance Benefits

- Keep Detailed Records: Always keep documentation of insurance premiums, especially those linked to business or medical expenses.

- Consult a Tax Practitioner: SARS regulations around insurance and tax can be complex. A registered tax advisor can help ensure you claim all available deductions correctly.

- Review Policies Annually: Update your insurance portfolio regularly to ensure your cover aligns with your income, expenses, and current tax laws.

- Use Structuring Wisely: For high-net-worth individuals, structuring life insurance policies within a trust can reduce estate duty exposure.

Frequently Asked Questions: Tax and Insurance in South Africa

Q: Can I deduct life insurance premiums from my South African taxes?

A: No, life insurance premiums are generally not deductible. However, they may play a key role in estate planning.

Q: Are medical aid contributions tax-deductible?

A: Not exactly. Instead, you receive a Medical Tax Credit—a fixed monthly rebate that reduces your tax payable.

Q: Can I claim car insurance as a tax deduction?

A: Only if the vehicle is used for business purposes. You can claim the business-use portion of your vehicle insurance.

Q: Is business insurance tax-deductible in South Africa?

A: Yes. Business insurance premiums related to company operations are generally tax-deductible.

Final Thoughts

In South Africa, insurance isn't just about protection—it's a strategic tool for managing your tax liability, preserving wealth, and supporting long-term financial stability. Whether you’re reviewing your medical insurance, planning your estate, or choosing the right business insurance, it’s essential to understand how these choices affect your tax outcomes.

With the right advice and a well-structured insurance portfolio, you can reduce your tax bill while ensuring comprehensive protection for yourself, your family, or your business.